Rumored Buzz on Paul B Insurance

Wiki Article

Some Ideas on Paul B Insurance You Should Know

Table of ContentsMore About Paul B InsuranceHow Paul B Insurance can Save You Time, Stress, and Money.Unknown Facts About Paul B InsuranceThe Definitive Guide to Paul B InsuranceHow Paul B Insurance can Save You Time, Stress, and Money.An Unbiased View of Paul B Insurance

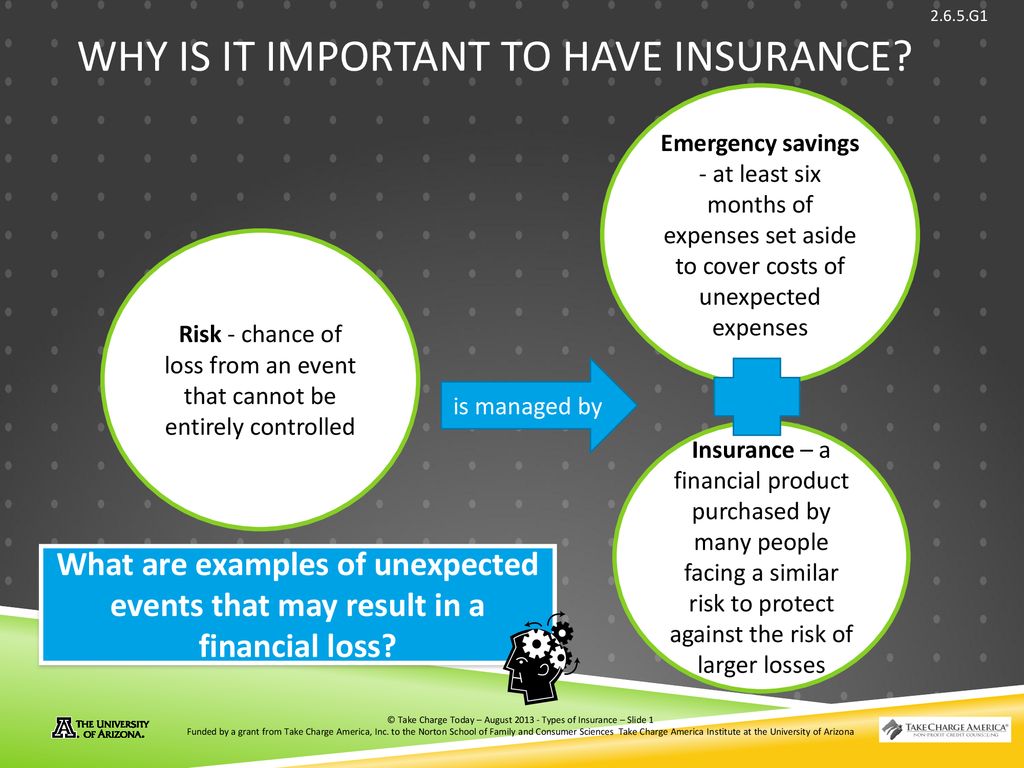

When it comes to a life insurance policy, several strategies permit an insurance holder can obtain their entire household covered. Practically all the insurance business offer the simple of insurance coverage premium calculator.General insurance coverage products come in various kinds covering a vast array of dangers such as health and wellness insurance coverage, motor insurance, aquatic insurance policy, obligation insurance, travel insurance policy and also commercial insurance coverage etc. Insurance policy is a reliable danger management device that secures what is valuable for us life, health and wellness, house and also services etc. The need of insurance policy might differ from one person to one more, however there are specific kinds of insurance policy products that are essential for every single individual for making certain a secure future.

Following insurance products are the essential for any individual today. As no one desires to leave their loved ones financially smashed, life protection is one of the essential for every specific having dependents. In case of life insurance policy, the amount assured or the protection amount will certainly be paid out to the candidate of the insured in the occasion of the fatality of the insured.

Motor insurance plan are the mandatory legal need in India for every single car proprietor under the Automobile Act. Be it two-wheeler, auto or a commercial vehicle, its compulsory to avail third event responsibility motor insurance coverage to protect oneself versus the cases that may develop from an additional event during a mishap.

The Best Guide To Paul B Insurance

The priority of any kind of insurance item might differ depending upon your individual requirement. Insurance coverage is a big market with many item kinds readily available to satisfy every sort of demand. Some of them discussed already are of top concern for each individual. Priority of remainder various other sorts of insurance might simply depend upon your distinct need or situation.Important disease insurance strategy may not be required for each person, particularly, if you do not have any family background of important health problem. Crucial illnesses are sometimes covered in health and wellness insurance strategies and likewise comes as a rider along with life insurance policy strategies. A standalone cover for important disease depends totally on the demand of an individual.

In some cases take a trip covers likewise come as your debt card travel advantage. There are several insurance coverage kinds that are not ideal or required for every individual. It is necessary to think of the advantages that you can reap before buying an insurance plan. Before you buy any type of insurance policy, it's important to recognize the requirement for insurance policy.

Purpose of cover Risks that you want to be covered against How lengthy you could require the insurance coverage Cost When trying to discover what insurance policy is, it is crucial to recognize its various parts. Currently that you have actually gone through the insurance coverage definition, have a look at several of its parts too: When it revives insurance meaning, coverage is an important part.

Top Guidelines Of Paul B Insurance

The premium relies on the selected sum guaranteed, the frequency of exceptional repayment, and the plan's tenure. A fantastic attribute of a life insurance policy is that the premium continues to be consistent throughout the term of the plan. Paul B Insurance. It is, as a result, typically advised that life insurance should be bought as early in life as possible.Guaranteed obtains the tax obligation advantages for costs paid depending upon the insurance product kind. For instance, the costs paid towards life insurance policy prepares gets approved for tax reduction under Section 80C of the Revenue Tax Obligation Act. As well as, the costs paid towards wellness insurance coverage intends why not try these out gets tax obligation deduction under Section 80D of the Earnings Tax Obligation Act.

30 lakhs running. Fortunately, Ram has taken a term insurance coverage cover of INR. 1 Cr. at the age of 32 years for 25 years of the policy period. His other half received payment from the insurance company within 10 days which assisted her settle the financial debt and also spend the corpus for future demands.

Sunil, a staff member in an international firm in Mumbai suddenly fell unconscious due to high fever. He was after that hurried to the local medical facility. He was admitted for 3 days in the medical facility for diagnosis as well as treatment. When he was discharged after 3 days, his medical facility bill came up to around INR.

Paul B Insurance - Questions

Fortunately, he had actually taken a health and wellness insurance policy coverage for INR. If he had actually not known the value of insurance, he would have to pay INR.70, 000 out of his pocket.

If the insurance claim is raised for INR 40,000 then the Copay sustained by the insurance policy holder will certainly be INR 4,000 et cetera of the INRV 35,000 will certainly be incurred by the insurer. While deductible is the fixed quantity that the insurance policy holder needs to go beyond in order to increase an insurance case.

Deductibles are an one-time restriction. When the policyholder crosses the insurance deductible limitation, he/ she does need not to pay any kind of other quantity until the following plan year.

Some Of Paul B Insurance

Insurance is a very special market. The entire worth of an insurance plan of any kind of kind stays within a simple promise: The guarantee to pay a possibly big benefit in the event of an insurance claim.

Although the total document of the insurance policy industry is superb no legit life insurance policy case, to call one line, has actually ever gone unpaid in the United States simply since an insurer came to be bankrupt. But the reality is that all insurance policy claims and also all annuity advantages undergo the claims-paying capability of the insurer.

There is much less threat in insuring with solid business than with insurance companies with find more info less stable resources structures. Furthermore, some errors and also noninclusions policies may not offer security to insurance coverage agents in cases arising from lower-rated insurance policy companies state, ranked B+ or even worse. There is no financial institution assurance available on insurance coverage items of any kind, neither exists any type of sort of federal insurance coverage readily available to back insurance provider that get involved in difficulty.

Best, Fitch or Requirement and also Poor's, the reduced your risk. Alan Wang, Alan Wang is the President of see here UBF and serves as the lead expert.

Paul B Insurance for Dummies

Consult with a representative: An insurance coverage agent can assist you examine your dangers as well as recommend insurance coverage options customized to your business dimension. When discovering the best company insurance coverage, there are a few crucial variables to think about. Picking one of the most thorough insurance coverage for your organization is crucial, as it can shield your firm from losses.Report this wiki page